What kind of data do investors see?

We run credit, background and fraud checks to determine the creditworthiness of all companies financing invoices. To help investors make an educated decision, we share the summary of our findings gathered from public databases (see below). Investors can also see information on previous invoices you have financed on the platform. We do not share confidential information or your customers' contact info.

Seller and debtor background

A short description of the seller and debtor company is provided in emails sent out to all investors.

Credit rating and probability of default

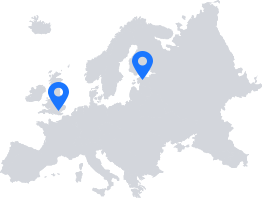

We use Estonia’s largest and most trusted credit scoring agency, Krediidiinfo AS (a subsidiary of Creditinfo Group), for the credit rating and likelihood of default score. In the UK, we use Experian and DueDil.

- The credit rating is expressed in letter combinations from AAA (highest) to B (lowest).

- Probability of default (PD%) shows the likelihood of the company falling into arrears within the following 12 months. This is displayed next to the credit rating.