In order to qualify to finance invoices through

- Be up and running for at least 6 months

- Be based in the UK

- Have a good credit standing

- Shouldn't have any ongoing court issues

Find out more about what the application process is like.

In order to qualify to finance invoices through

Find out more about what the application process is like.

During your sign up, we will ask you to upload bank statements from all banks your business has accounts in. The statements should show the past 6 months of your account activity.

That's it. If we need any other documents, we will contact you personally.

Once you have submitted your info and bank statements to us, the process should take about 1-3 days depending on the quality of the documents and level of communication between your company and our team.

We will not contact any of your customers before you sign the contract and never without your prior permission. Once we make you an offer and sign the contract, we will ask your permission to contact your customer in order to verify the first invoice.

We've worked very hard to make the application process as simple and straightforward as possible. In order to finish your application there are three main things you have to cover:

Once we have your application, we will contact you straight away and introduce our offering with a credit limit and expected costs. After that, you are ready to sell your first invoice.

Invoice financing is a simple way for businesses to improve their cash flow by selling their invoices and getting cash right away compared to waiting out the 15-120 day terms typical for invoices to be paid by clients.

At

Invoice finance can be used for many business reasons but is an especially great fit for companies that experience long payment terms for the invoices they issue or irregular expenditures.

Invoice financing allows you to unlock cash from your invoices immediately. You can use that to:

Invoice finance is not suitable if your clients are already or consistently delayed.

Yes! That's one of the best parts about using

Unlike banks,

Unlike banks,

Take a look below at some key differences:

Factoring:

Invoice financing:

Usually within one working day after the end of the auction.

Once your invoice has been funded, you will have to either send your customer a repeating invoice or inform them that some of the payment details have been changed. On the invoice itself, you will have to change the bank account number but can keep your company name and all other details the same.

When the customer confirms that he has received the new details, we will transfer the cash for your invoice to your account.

We fund invoices which are issued to companies in the UK and abroad.

An invoice should clearly indicate:

An invoice cannot have:

Banks usually finance 70-85% of your invoices, keeping the rest of the money in reserve until the invoice is paid.

When you initially sign up as an invoice seller, we will have to contact the buyer of your invoice to confirm details. Although, we will never contact your customer without your prior consent.

There is a possibility to finance invoices confidentially. In that case, there will be a special procedure to verify the receipt of goods/services and confirmation of invoice details.

During the onboarding call with the

Once you have uploaded an invoice it goes to auction. Many different investors place bids of varying sums and interest rates and we sort out the best deal for you. You don't have to do anything, it's all automated.

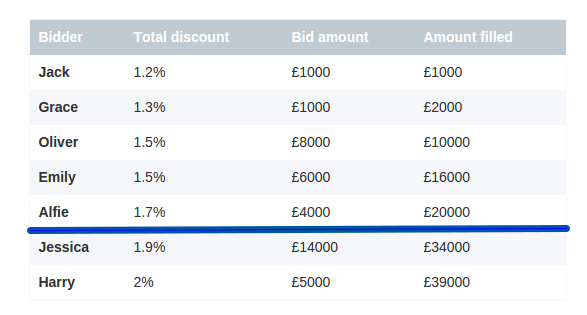

Let's say there is a £20,000 invoice being financed in the auction:

The blue line represents the sum at which the bid is fulfilled.

Once the invoice amount is fulfilled, investors are still able to make bids but they have to be lower than the highest competing bid in order to be considered.

The invoice gets financed by the last interest rate filling the auction, which, in this example would be 1.7%.

The signup is free. You are able to register and get a quote on the platform absolutely free.

We charge per invoice. There are no ongoing, subscription or any other hidden fees. Typically it's a one-off fee of 1.5-3.1% per 30 days invoice.

On our platform, you will always be quoted the total cost.

We see that some finance providers aren't always straightforward about the fees they charge, leading on businesses with unexpected costs. While selling your invoices through

If you want to dig deeper and understand the cost components within...

The total discount amount includes the investor interest and

EXAMPLE:

Let's say you have a £10,000 invoice you would like to finance. The payment due is within 30 days and the monthly discount is 1%.

Please see our blog post for more information regarding auctions.

We run credit, background and fraud checks to determine the creditworthiness of all companies financing invoices. To help investors make an educated decision, we share the summary of our findings gathered from public databases (see below). Investors can also see information on previous invoices you have financed on the platform. We do not share confidential information or your customers' contact info.

Seller and debtor background

A short description of the seller and debtor company is provided in emails sent out to all investors.

Credit rating and probability of default

We use Estonia’s largest and most trusted credit scoring agency, Krediidiinfo AS (a subsidiary of Creditinfo Group), for the credit rating and likelihood of default score. In the UK, we use Experian and DueDil.

The financial information you provide to

We will not share your bank statements with your customers, investors, or any third parties.

The information you provide to

For detailed information, please take a look at our privacy policy.

We finance invoices issued to businesses and the public sector. We do not to finance invoices issued to private individuals or sole proprietors.

Yes! We accept export invoices issued to companies in most countries around the world. If you are interested, let us know and our client manager will give you more specific feedback.

Invoices should preferably be in pound sterlings.