How much do I have to pay per invoice?

On our platform, you will always be quoted the total cost.

We see that some finance providers aren't always straightforward about the fees they charge, leading on businesses with unexpected costs. While selling your invoices through Investly there will be a one-off small fee of 1.5%-3.1% per invoice for a 30-day invoice and we will always quote you the total fee with no hidden or monthly costs.

If you want to dig deeper and understand the cost components within...

The total discount amount includes the investor interest and Investly's fee.

EXAMPLE:

Let's say you have a £10,000 invoice you would like to finance. The payment due is within 30 days and the monthly discount is 1%.

- Monthly interest rate = 1%

- Investly fee (1%, minimum £50) = 1% * £10,000 = £100

- Monthly interest amount = (Invoice amount - Investly fee) - (Invoice amount - Investly fee)/(1+monthly interest rate) = (£10,000 - £100) - (£10,000 - £100)/(1+0,01) = £98

- Total discount = Monthly interest + Investly fee = £98 + £100 = £198

After financing your 30 day £10,000 invoice you will receive £9,802.

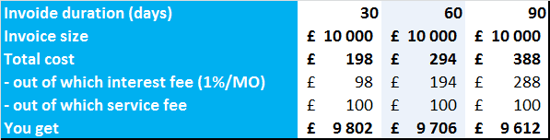

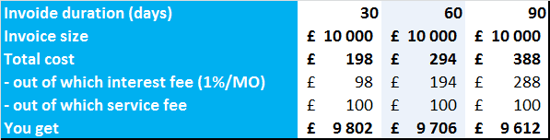

Here's a table for different payment terms following the same example:

The final cost can actually be lower than the initial quote due to our competitive auction system in which investors bid down the financing cost for you.

The final cost can actually be lower than the initial quote due to our competitive auction system in which investors bid down the financing cost for you. See how we deliver the

best rates on the market.

The final cost can actually be lower than the initial quote due to our competitive auction system in which investors bid down the financing cost for you. See how we deliver the

best rates on the market. he final cost can actually be lower than the initial quote due to our competitive auction system in which investors bid down the financing cost for you. See how we deliver the best rates on the market.

he final cost can actually be lower than the initial quote due to our competitive auction system in which investors bid down the financing cost for you. See how we deliver the best rates on the market.

The final cost can actually be lower than the initial quote due to our competitive auction system in which investors bid down the financing cost for you. See how we deliver the

best rates on the market.

The final cost can actually be lower than the initial quote due to our competitive auction system in which investors bid down the financing cost for you. See how we deliver the

best rates on the market.

The final cost can actually be lower than the initial quote due to our competitive auction system in which investors bid down the financing cost for you. See how we deliver the

best rates on the market.

The final cost can actually be lower than the initial quote due to our competitive auction system in which investors bid down the financing cost for you. See how we deliver the

best rates on the market.

The final cost can actually be lower than the initial quote due to our competitive auction system in which investors bid down the financing cost for you. See how we deliver the

best rates on the market.

The final cost can actually be lower than the initial quote due to our competitive auction system in which investors bid down the financing cost for you. See how we deliver the

best rates on the market.

The final cost can actually be lower than the initial quote due to our competitive auction system in which investors bid down the financing cost for you. See how we deliver the

best rates on the market.

The final cost can actually be lower than the initial quote due to our competitive auction system in which investors bid down the financing cost for you. See how we deliver the

best rates on the market.

The final cost can actually be lower than the initial quote due to our competitive auction system in which investors bid down the financing cost for you. See how we deliver the

best rates on the market.

The final cost can actually be lower than the initial quote due to our competitive auction system in which investors bid down the financing cost for you. See how we deliver the

best rates on the market.

The final cost can actually be lower than the initial quote due to our competitive auction system in which investors bid down the financing cost for you. See how we deliver the

best rates on the market.

The final cost can actually be lower than the initial quote due to our competitive auction system in which investors bid down the financing cost for you. See how we deliver the

best rates on the market.

After selling your 30 day £10,000 invoice you will receive £9,802. Here's a table for different payment terms following the same example:

After selling your 30 day £10,000 invoice you will receive

£9,802. Here's a table for different payment terms following the same example:

After selling your 30 day £10,000 invoice you will receive £9,802. Here's a table for different payment terms following the same example:

After selling your 30 day £10,000 invoice you will receive £9,802. Here's a table for different payment terms following the same example:

After selling your 30 day £10,000 invoice you will receive £9,802. Here's a table for different payment terms following the same example:

Let's say you have a £10,000 invoice you would like to sell. The payment is due in 30 days and the monthly discount is 1%.

- Monthly interest rate = 1%

- Investly fee (1%, minimum £50) = 1% * £10,000 = £100

- Monthly interest amount = (Invoice amount - Investly fee) - (Invoice amount - Investly fee)/(1+monthly interest rate) = (£10,000 - £100) - (£10,000 - £100)/(1+0,01) = £98

- Total discount = Monthly interest + Investly fee = £98 + £100 = £198

Let's say you have a £10,000 invoice you would like to sell. The payment is due in 30 days and the monthly discount is 1%.

Let's say you have a £10,000 invoice you would like to sell. The payment is due in 30 days and the monthly discount is 1%.

Let's say you have a £10,000 invoice you would like to sell. The payment is due in 30 days and the monthly discount is 1%.

- Monthly interest rate = 1%

- Investly fee (1%, minimum £50) = 1% * £10,000 = £100

- Monthly interest amount = (Invoice amount - Investly fee) - (Invoice amount - Investly fee)/(1+monthly interest rate) = (£10,000 - £100) - (£10,000 - £100)/(1+0,01) = £98

- Total discount = Monthly interest + Investly fee = £98 + £100 = £198

Let's say you have a £10,000 invoice you would like to sell. The payment is due in 30 days and the monthly discount is 1%.

- Monthly interest rate = 1%

- Investly fee (1%, minimum £50) = 1% * £10,000 = £100

- Monthly interest amount = (Invoice amount - Investly fee) - (Invoice amount - Investly fee)/(1+monthly interest rate) = (£10,000 - £100) - (£10,000 - £100)/(1+0,01) = £98

- Total discount = Monthly interest + Investly fee = £98 + £100 = £198

Let's say you have a £10,000 invoice you would like to sell. The payment is due in 30 days and the monthly discount is 1%.

- Monthly interest rate = 1%

- Investly fee (1%, minimum £50) = 1% * £10,000 = £100

- Monthly interest amount = (Invoice amount - Investly fee) - (Invoice amount - Investly fee)/(1+monthly interest rate) = (£10,000 - £100) - (£10,000 - £100)/(1+0,01) = £98

- Total discount = Monthly interest + Investly fee = £98 + £100 = £198

-

Let's say you have a £10,000 invoice you would like to sell. The payment is due in 30 days and the monthly discount is 1%.

- Monthly interest rate = 1%

- Investly fee (1%, minimum £50) = 1% * £10,000 = £100

- Monthly interest amount = (Invoice amount - Investly fee) - (Invoice amount - Investly fee)/(1+monthly interest rate) = (£10,000 - £100) - (£10,000 - £100)/(1+0,01) = £98

- Total discount = Monthly interest + Investly fee = £98 + £100 = £198