A classic auction involves participants making ever-higher bids. That is the model used by eBay, for example. Investly uses reverse auctions, where participants make ever-lower bids. Investors bid on invoices, bids compete by lowering the discount rate. After one to three days the auction ends and the company is given the amount in cash, minus the discount. On the due date, the customer pays the invoice in full and the investor receives their initial investment plus interest.

Who sets the interest rate?

Investly does not set the final interest rate, unlike a lot of peer to peer lending platforms. Although Investly sets the initial interest rate, the final rate is determined by investors. The interest rate is a reflection of investor demand, which depends on the return they could get by investing in other, similar assets, the business cycle, the company that is asking for financing and numerous other factors. The interest rate is thus a function of both supply and demand.

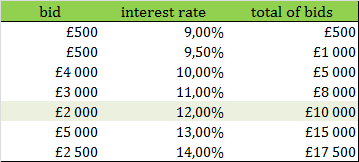

The final rate is determined during the auction. Let’s have a look at an example: a company decides to sell a £10,000 invoice. Investors make bids by setting the amount and interest rate they are happy with. After making the bid, the funds are reserved (reserved funds cannot be used to make bids on other auctions). If the investor is outbid, the investor’s funds are released. Every investor can make multiple bids on the same auction, varying the size and the interest rate of each bid. Once the funding target has been reached, investors can still make bids, albeit at a lower interest rate.

The bids with the lowest interest rate are counted first (see third column, sum of bids). The first five bids are enough to fill the financing target. The final interest rate is set by the last bid that was needed to reach the financing target. In this case, the interest rate for all investors participating is 12%. The last two bids did not compete.

For simplicity’s sake, costs have not been included in this example. In reality, a company is given the amount in cash minus the discount. The discount covers the service fee and investors’ return. For example, a company selling a 20 day invoice would receive approximately £9,852. You will find an approximate cost calculator on this page.

Underwriting

Investly provides a marketplace where supply meets demand. Much like eBay, we don’t underwrite the auctions, because we are not in the business of providing financing, but of intermediating it. However, the founding team at Investly makes bids on all auctions with their personal capital. In addition, a few employees participate on some auctions. Investly as a company does not make bids. This way our interests are aligned with investors’ without jeopardising the equity of the company.

Risk management

We run a full risk assessment before allowing any company or invoice on the platform. On the auction page, we display a credit score and a default probability for both the invoice seller and the debtor (the customer). For some companies, you will see the director has provided a personal surety, this information can be found on the financials page of the company.

Diversification

Investing is risky. It is good practice to diversify your investments to decrease your exposure to any single invoice or company. The more diversified your portfolio, the closer your return will be to matching the platform’s average return. Our minimal bid size is relatively small, this means that diversifying your portfolio is relatively easy even with a smaller account.